Pay Your Property Taxes Online

- If an e-check payment is submitted with the incorrect account information or returned unpaid for any reason, a fee of up to 5% may be charged, per Florida Statute 125.0105.

- Electronic check payment (No Fee)

- Payment by credit/debit card (Fee)

- Credit Card fee is 2.55%

- Credit card fees are collected by the credit card companies, not Broward County.

Pay your current taxes by mail.

- Should your check not clear for any reason, your payment will be cancelled, and you will be charged a returned check fee.

- Payments sent without the payment coupon will cause a delay in processing.

- Make Check Payable to: Broward Tax Collector

Mail to:

Broward Constitutional Tax Collector

P.O. Box 105048

Atlanta, GA 30348-5048

Or Mail Overnight to:

Broward Constitutional Tax Collector

3585 Atlanta Avenue

Hapeville, GA 30354-1705

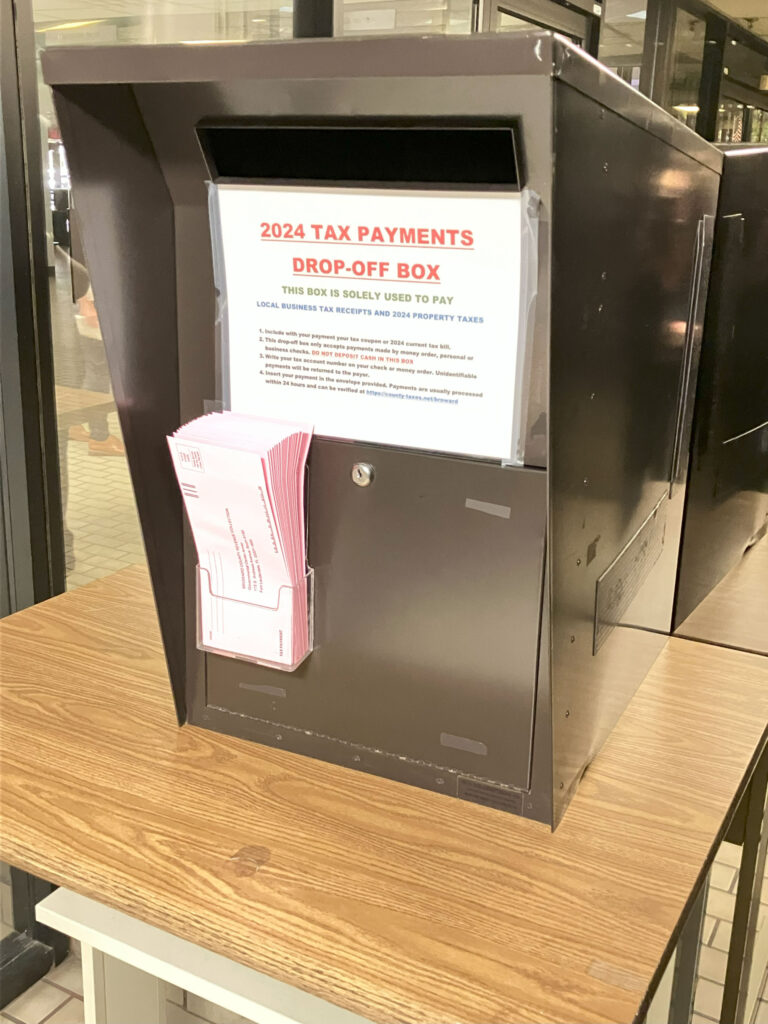

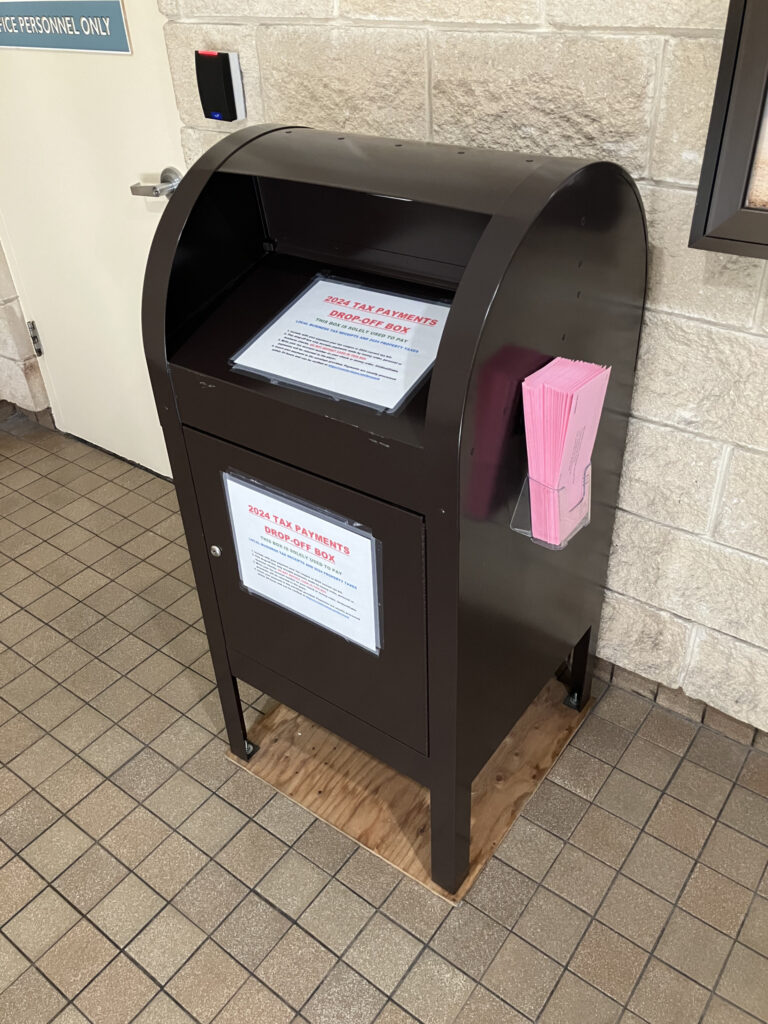

Pay your current taxes in person.

- Bring your payment to one of our secure drop-box locations. Secure drop-boxes are checked twice daily and are located next to the security posts on Brickell Avenue at the Broward Governmental Center.

Broward Government Center

115 S Andrews Ave

Fort Lauderdale, FL 33301

Pay Your Property Taxes with a Partial Payment Plan

- To enroll, write “partial payment” in the memo line of your check or call our office at 954-357-4829 to request that your account be enabled for partial payments.

- You cannot make online partial payments until we enable your account to accept them

- You can divide your tax bill into 5 partial payments

- A minimum partial payment of $100 must be made

- Wells Fargo does not accept partial payments

- Partial payments are only accepted for the current tax bill

Pay Your Property Taxes with an Installment Payment Plan

- Save 3.5% on your tax bill when you enroll

- Once you fully enroll, you do not need to reapply each year

1st Installment

Paid by June 30.

Taxes Discounted by 6%

2nd Installment

Paid by September 30

Taxes Discounted 4.5%

3rd Installment

Paid by December 31

Taxes Discounted 3%

4th Installment

Paid by March 31

No Discount

To enroll:

- Click here to search for your account, then click “Apply for the 2025 installment payment plan” and submit application

- Respond to confirmation email

- Pay your first installment by July 31

Pay your Property Taxes Early to Receive a Discount

- 4% when property taxes are paid in full in November

- 3% when property taxes are paid in full in December

- 2% when property taxes are paid in full in January

- 1% when property taxes are paid in full in February